Coronavirus and Markets

In view of the recent stock market volatility, we felt it was appropriate to issue a client briefing note.

Stock markets have been sent sharply lower by news that the coronavirus is continuing to spread outside mainland China, with clusters now in Italy and Spain in addition to an uptick in cases in Iran and South Korea.

More encouragingly, reports suggest that the number of cases is stabilising in the Chinese province of Hubei, where the virus was first discovered.

Even so, as the virus spreads to other parts of the world, risk assets are being sold off, and investors are heading into perceived safe havens such as gold and government bonds.

What should investors do?

Worrying as this outbreak is, we are advising clients not to allow fear to govern their decisions. We have been in similar territory before in terms of health scares, and there are lessons to be learned from previous outbreaks such as SARS, Ebola, MERS and Zika.

Given its Chinese origins, the SARS outbreak in 2003 is the best comparison, although circumstances are very different today. Back in 2003, China’s share of global GDP was just 4%. Today it is almost 16%, so there is more at stake.

Share market valuations around the world are also higher, and we are at a later stage of a more mature economic cycle.

Nevertheless, history has shown it is better to ride out near-term volatility and wait for markets to recover in the medium term.

Without downplaying the human tragedy or the looming economic fallout, we suspect the current crisis will share some similarities with the SARS outbreak.

It is worth noting that Asia ex Japan equities bottomed out in 2003 shortly after the rate of change in total SARS cases definitively began to move lower.

In just the same way, earlier this month, we saw equity markets rally on the back of data showing that the rate of new coronavirus cases in China had slowed.

Equities should remain in demand

Global Equities (shares) expected earnings in 2020 were vulnerable to any new bad news, and that came with reports of the virus spreading into Europe. Ironically, that will mean the prospect of higher returns on cash or bonds becomes an even dimmer prospect – market interest rates now suggest that investors believe it is highly likely interest rates will be cut in the US and UK this year, meaning there should be continued demand for equities, which offer the prospect for higher returns.

So, we are encouraging investors to focus on the medium term. It is important to remember that consumption has not disappeared – it has merely been postponed and if the outbreak is contained relatively quickly, this delaying of economic activity can give markets a significant boost a little further down the line because it will lead to a surge in activity in forthcoming quarters, as economies recover.

Countries are taking extraordinary steps to contain the virus and pharmaceutical companies around the world are working towards a vaccine at a record pace, with reports that human testing could begin in April.

For equities to begin rallying, however, investors will need to see evidence that the rate of growth of new coronavirus cases outside of China is being quickly contained.

How have our portfolios performed in the “Coronavirus slump”?

Our portfolios have “held up” well during the market sell off and we are pleased to report that they are operating well within their risk tolerances.

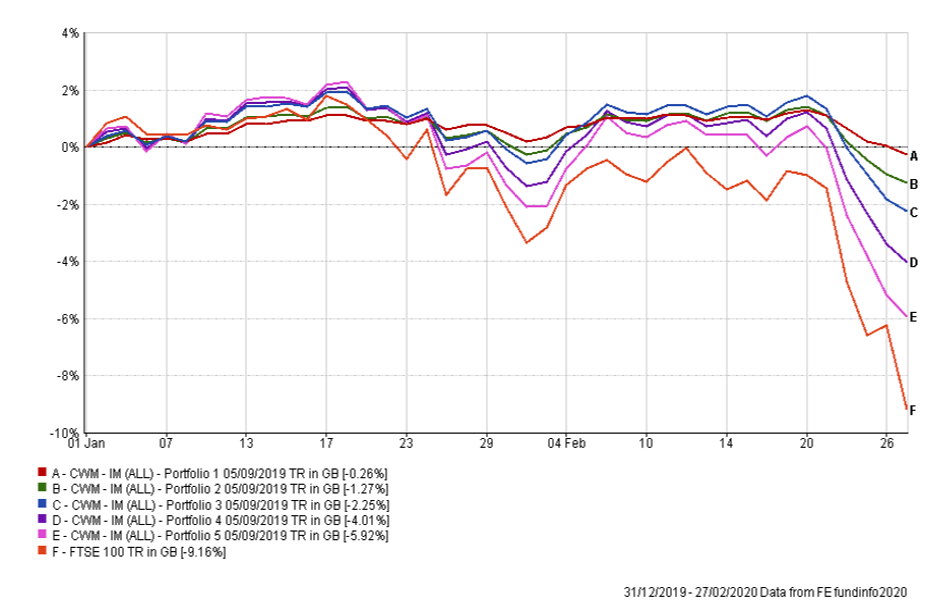

The graph below compares our CWM IM portfolios performance from 1st January 2020 to date. For reference we have enclosed the performance of the FTSE 100 as a comparison.

Our most commonly used mandate is CWM IM 3, where year to date the underlying portfolio is -2.25% compared to -9.16% from the FTSE 100 Index.

The value of investments can fall and you may get back less than you invested.

Past performance is not a guide to future performance.

No investment is suitable in all cases and if you have any doubts as to an investment’s suitability then you should contact us.

If you invest in currencies other than your own, fluctuations in currency value will mean that the value of your investment will move independently of the underlying asset.

The information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

Group.

Group.